The UK Economy: Lots of Problems, Few Solutions - part two **As featured on the LOTUS EATERS**

The UK Economy – Lots of Problems, Few Solutions

Part Two

Housing Crisis

The property market and its many problems are so complex and layered that many analysts speak of multiple housing crises at once. In the UK, there is a never-ending housing bubble. House price in Britain have increased by over 200% since 2000 meanwhile - as we saw previously - wages have stagnated during that same period. Various governments have consistently pledged to remedy the problem but in truth very little has been achieved.

A number of factors have caused this crisis, including: mass immigration, the difficulty of planning laws that must be navigated in order to build new homes, a genuine lack of affordable housing, investment from overseas, the asset bubbles that formed as a result of a prolonged period of low interest rates after the 2008 crisis and much more.

The cost of renting just keeps going up and buying is out of reach for many first-time buyers and young people. The UK has some of the highest housing costs in the world with a distinct lack of affordable options for both buyers and renters. House prices are approximately nine times what earnings are, the result of flatlining wages and skyrocketing house prices. The average housing deposit is around £60,000 which is very difficult to reach if you are renting. The government must subsidise the market to the tune of £23 billion a year in housing benefit for people in private accommodation, essentially the government is subsidising the housing market with landlords being the ultimate beneficiary under this farcical arrangement. There is a lack of social housing and a lack of renting options as well, while conversely many luxury properties sit idle without tenants or buyers.

Investment in property from abroad has distorted the property market making homes in some parts of the country unaffordable for many. Immigration is another reason why we have a housing problem in the UK, as the country’s population has increased exponentially over a short time-period and avoiding an inflationary effect on housing prices is impossible as such. All of these problems have led to greatly increased housing costs, a lack of available housing and generally poorer quality housing as well. In fact, the UK has some of the highest prices, poorest quality and smallest housing in Western Europe.

Britain has been struggling with a lack of affordable homes for so long now that many people just accept the situation as the new normal. Although property values have come down slightly recently, this hasn’t really helped first time buyers and young people because of the poor state of the economy, particularly the climate of high interest rates and high inflation.

In recent years, the British government has prioritised purpose-built, temporary or short-term accommodation such as care homes, student residences and properties designated for short-term rentals as opposed to actual homes for families. Many feel that this has further distorted the housing market, compounding the problem is the role that Airbnb plays in all this which has led to further distortions in the market as many feel it allows landlords to profit more from short-term rentals as opposed to selling or leasing, especially in big cities and when house prices are falling (as they have been currently).

Mortgages

Short-term fixed rate mortgages account for the highest percentage of mortgages in the UK. A short-term fixed rate mortgage means that the interest rate for the first two years is pegged to a very low rate and after two years it matures to higher rates. Many mortgages are set to mature but because interest rates are currently high this is going to cause a lot of problems up and down the country as people see their interest rates on their homes rise from one or two percent to possibly seven or even eight percent. If people cannot keep up with payments on their mortgages this could lead to a wave of property sales or, even worse, foreclosures. At the very least it means less money circulating in the economy as people tighten their belts to cope with rising interest payments.

Privatisation of Utilities / Energy

The privatisation of the nation’s public utilities is a contentious issue in the UK. The issue dates back to the late 1970s but overwhelming evidence suggests that the transfer of Britain’s energy and water supply into private hands has not been in the best interests of the citizenry and that currently only the shareholders are really benefiting from the current arrangement. Its time for a change!

Margaret Thatcher privatised the water supply in 1989 and water companies are now in debt to the tune of £54 billion.1 The quality of our water continues to decline as well, with water companies discharging vast amounts of sewage into our rivers and the sea,2 a problem compounded by our decaying sewage system which has contaminated the water supply in parts of the country with lead and rust, among other things. Britain’s sewage system is in desperate need of repair and the British water system as a whole loses 25% of its water due to leakages.

Privatisation of the rail network has been a catastrophe, leading to higher prices and more delays. Britain’s rail fares are six times more than the European average and strikes by the RMT and ASLEF trade unions continue to cause huge disruptions up and down the country.

The UK is the only country in Europe (along with Portugal) that has a privatised electric grid, 98% of which is owned by private investors from abroad. As a result, Britain has some of the highest electricity prices in the developed world, despite having access to our own oil in the North Sea.3

Foreign ownership of many of Britain’s leading utility companies complicates the problem even further. Currently, 70% of Britain’s water is owned by foreign firms. A lot of these companies are floated on the stock exchange and are happy to raise prices for consumer as a means of returning higher gains for their shareholders.

Nationalised utilities once favoured unions but privatised utilities favour shareholders. More than two-thirds of the country want water, electricity and rail companies to be under public ownership and to date the British tax payer has already spent £2.7 billion bailing out failed energy companies.4

Britain’s tax policies

The UK needs to reevaluate its tax system. We are taxed on what we earn and what we spend. Council tax is based on property values in 1991 meaning that regions where house prices have increased (particularly London and the South East) are paying less in council tax compared to regions where house prices have not increased as much. Stamp duty – which people pay every time they change property - is an arbitrary and punitive tax that should be abolished. VAT is incredibly imbalanced with many goods not being subject to the main 20% and being charged at 0% (children’s clothing and most food) costing the Treasury £64 billion annually.5 Meanwhile, the UK’s highest corporate tax rate, currently 25%, is simply too high and makes the country uncompetitive.6 Britain needs a flat tax to level up the country and to make its tax code more simple and fairer, while there is a strong case for some taxes being abolished altogether (namely stamp duty and inheritance tax). However, abolishing these taxes and levelling up would mean an immediate short-fall in tax revenue that even in the short-term the government could ill afford given the scale of our current problems.

Secondary Effects

The United Kingdom’s economic problems have spread to other areas of the country. Britain’s schools are failing by almost every metric, the healthcare system is on the verge of collapse and is in desperate need of reform, the judiciary has a backlog of cases clogging up the legal system, prisons are full and law enforcement is struggling as well. The UK’s declining economic fortunes means the British government has less money for all its public services, services that are in desperate need of funding.

The government’s response to the 2008 global financial crisis saw the UK run unprecedented deficits in order to bail out the banks and to prevent a complete collapse of the country’s economy. As a result, the government reduced public spending and began an extensive period of austerity under former Prime Minister David Cameron. After which, a combination of Brexit, the pandemic, geopolitical events, soaring inflation and rising interest rates further reduced government revenues. The economy is weak and debt repayments are high, the problem is that the government cannot borrow in order to help with the cost of living crisis or to help our struggling public services because borrowing is too expensive presently.

The UK’s public services are in desperate need of investment and funding, and the longer they go without this funding the worse the country’s predicament becomes.

Infrastructure

Years of under-investment in basic infrastructure has meant that schools, hospitals, roads and public buildings are literally crumbling. Buildings in the 60’s and 70’s were built using a cheap aerated concrete and are now showing signs of deteriorating.7 The National Audit Office has stated that 700,000 pupils are in schools that require serious and urgent repair.8

The problems created by decades of under-investment will take years of work and billions of pounds to resolve. The Grenfell Disaster in 2017, where 72 people died in a fire that was largely the result of inadequate cladding and insulation materials, is symptomatic of Britain’s infrastructure problems.

New infrastructure is difficult to build in the UK mainly owing to difficulties with planning permission and other onerous regulations, expensive labour and materials, poor transport links and a lack of government funding. These will have to be addressed in the future as Britain’s deteriorating infrastructure is contributing to its low productivity and poor economic growth.

It is ironic that these problems extend to the Palace of Westminster itself, which is in need of urgent repair, requiring an estimated £22 billion of investment; even the elites aren’t spared the embarrassment of the UK’s decline.9

Education

An entire article could be written on the failure of Britain’s education system. Schools in the UK are running out of both money and teachers.10 Many of Britain’s schools have combined classes (classes with up to 60 students in one classroom), non-specialist teachers (using support staff and trainee teachers) and even employ self-teaching.11 Some schools have truancy officers to help manage the high numbers of absent students and the idea of undergraduate tutors to help failing students has even been proposed. Astonishingly, some pupils are even forced to watch lessons on You Tube in place of conventional classes with qualified teachers. A record 40,000 teachers quit the profession in 2022 owing to the demands of the job: namely the long hours, low pay and stressful conditions.

The annual Ofsted report for 2022 says stated that absenteeism has become a real problem and that disruptive behaviour is on the rise.12 The same report explains how the social contract between parents and schools has been broken with teachers being abused both in person and online.

The NHS

The NHS is not fit for purpose and is need of major reform. The NHS has become the single biggest structural problem in the country which costs a fortune but delivers a relatively poor standard of care. Britain’s NHS costs £200 billion annually and no one can get in: at one stage, 1.5 million people waited over a month to see a doctor. There are currently 7.5 million people on NHS waiting lists and 130,000 unfilled positions.13 Staggeringly, there were 23,000 excess deaths in 2022, the result of long A&E waiting times with more than a million patients waiting for 12 hours or more.14 As a result of the NHS backlog, 2.5 million people are economically inactive due to long-term sickness.15 The UK spends less on healthcare than many developed countries.

Source: BBC

Poverty

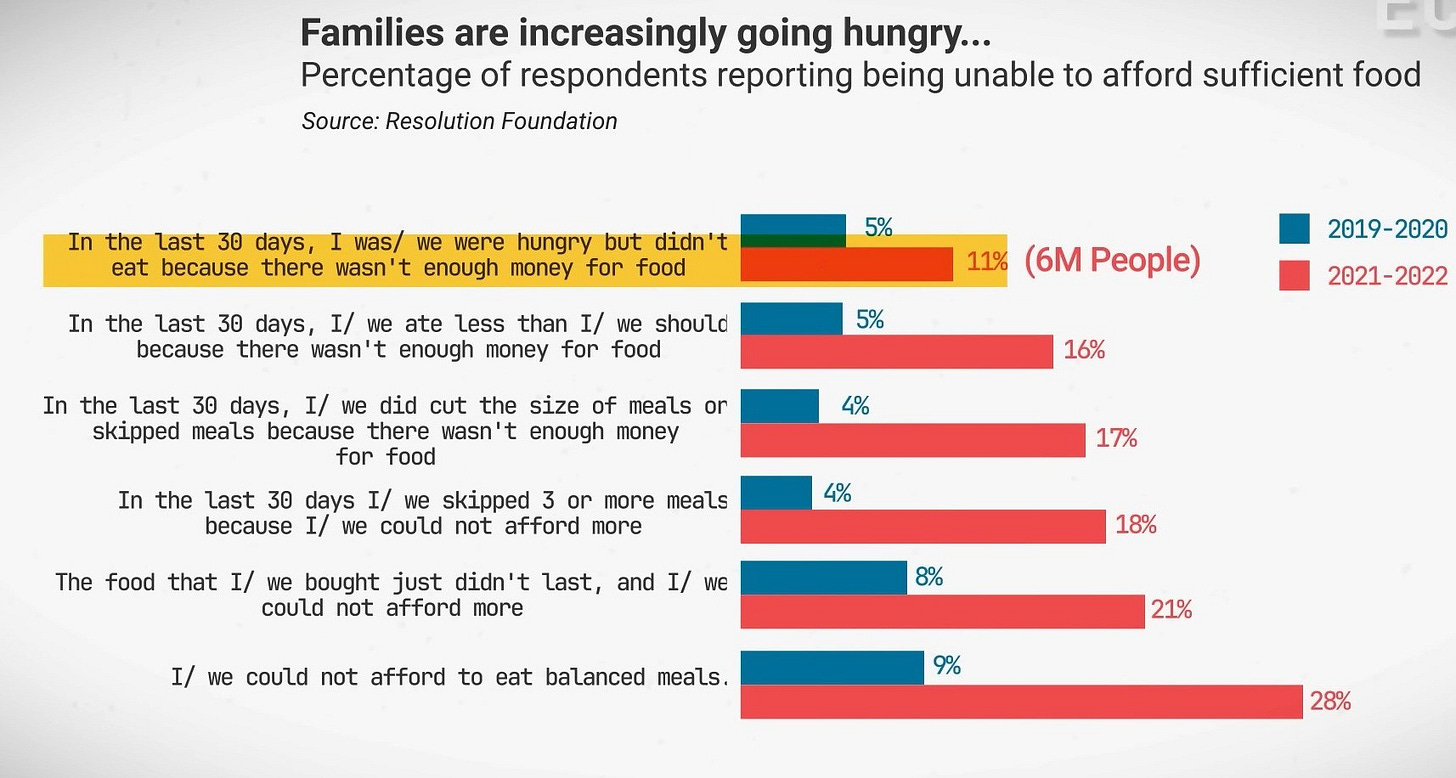

Everything l have spoken about till now is really starting to have a negative impact on the quality of life of every day Britons by forcing more and more people into poverty: more homelessness, more people at food banks and more people reliant on the government for support and welfare. Around 14.4 million people were in poverty in 2022/23 with almost 3 million people using food banks during that time frame (see below).16

One study found that 11 percent of the population (equivalent to 6 million people) go without food because of financial problems. There are 4.2 million children living in poverty, 1 in 3 children,17 120,000 of which are living in destitution (the most serious category of poverty).18 Not too long ago, “heat or eat” became the slogan to describe how Britons are increasingly being forced to choose between heating their homes or filling their dinner plates.19 It is important to keep in mind that many of those in poverty come from working households.

Local City Councils

Many councils are on the verge on bankruptcy, Nottingham City Council the latest among them,20 Birmingham Council is on the brink of bankruptcy as well with budget shortfalls said to be in the hundreds of millions of pounds.21 Councils have been crippled by inflation, government cuts and a rising demand for social and welfare services but mismanagement, bad decision making and poor allocation of funds all form part of the problem.

Related Problems

I wanted to give a quick nod to the following issues which, in all honesty, probably merit an article all to themselves in order to fully extrapolate their impact on the country. However, for reasons of practicality, I have decided to keep them short and to the point.

Brexit

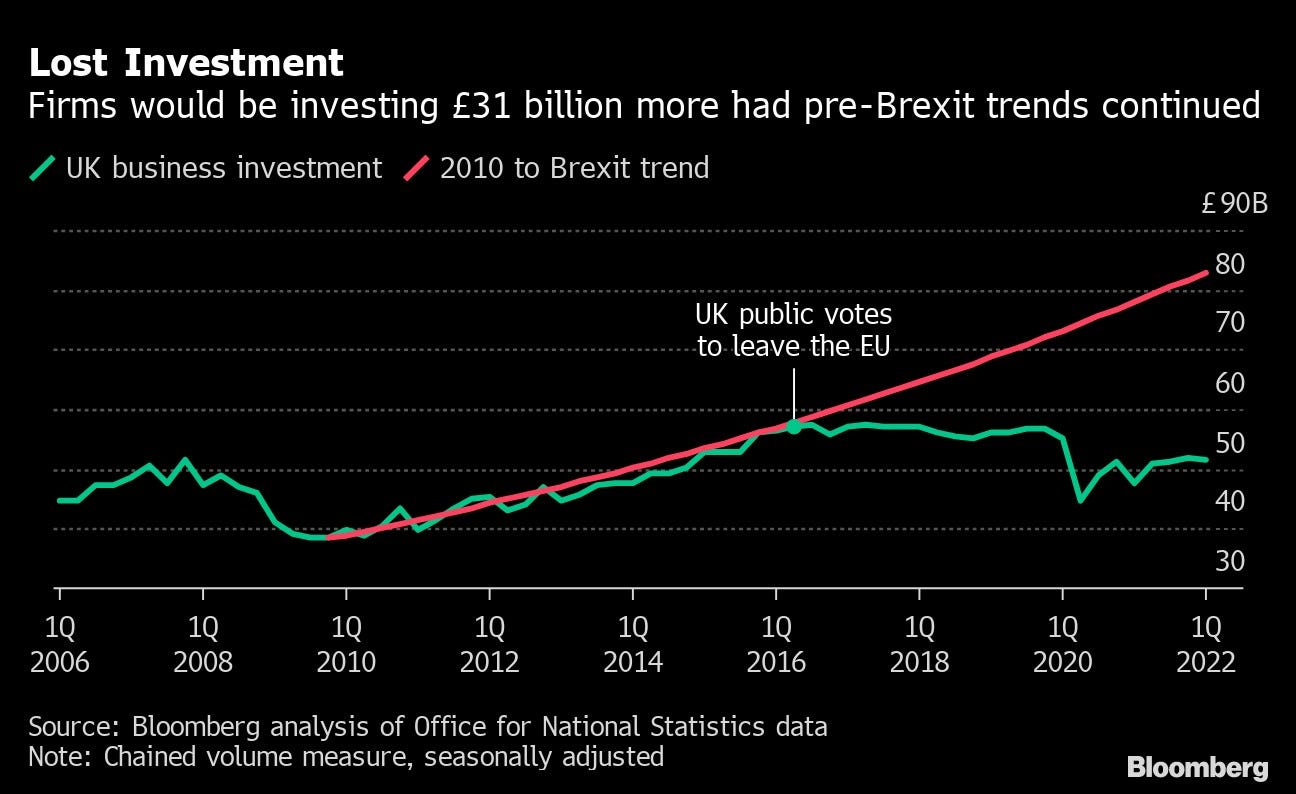

Brexit has negatively impacted the UK economy in several ways. Goods we import from the EU are now taxed and the pound has devalued by 13% against the euro making imports more expensive for consumers.22 Meanwhile, exports have declined because of higher import costs for components and materials and also because of more bureaucracy related to new and complicated customs declarations. Lastly, investment (as we saw in part one) has declined post-Brexit as well. Many have forecasted that Brexit will amount to a net loss to GDP of around 5% or the per capita equivalent of £2,300 per person less.23

Selling too many companies and assets to foreign investors

Far too many famous, world-renowned British companies have been sold to foreign suitors for short-term, personal gain. The list of famous British brands and companies that have been sold to overseas buyers is as long as the Yellow Pages: Pilkington, O2, Body Shop, Jaguar, Typhoo Tea, Harrods, Leyland Motors, Rolls-Royce, Cadbury's, Fred Perry and Rowntree Macintosh among others. In doing so, the UK has effectively asset stripped itself.24 Now the money spent on these famous brands does not stay here. Even our beloved football clubs are now in the possession of foreign owners. It is a truly farcical situation that these have been turned over to foreign ownership so that a select, greedy few could get rich from their sale.

Mass Immigration

Mass immigration is a problem that impacts almost everything that I have mentioned till now. Britain’s demographic explosion has placed tremendous strain on our public services, housing and infrastructure and the result is that we have ended up with a country that is ill equipped to deal with the amount of people we have, especially in the cities. The UK has had large amounts of immigration in a short amount of time over our relatively small landmass and the impact on our public services has been startling. It also needs to be mentioned that avoiding an inflationary effect on prices is impossible given the large waves of people that have come to the UK. This is to say nothing of the various non-economic costs associated with mass migration into Britain that we must contend with on a daily basis. While growth has stagnated (as we looked at it part one), the population continues to grow exponentially; this means fewer goods and services for everyone. The problem will only get worse as more people arrive here.

Regional Inequality

Owing to the rapid growth of the City of London and the deindustrialisation of the North, the UK is a geographically uneven country with 47% of GDP concentrated in London and the South East. Disposable income is 50% higher in London compared to other areas of the country like the North East, Wales and Northern Ireland. Britain has a London-centric economy based around financial services and income inequality is high compared to other developed countries according to the OECD.25

For decades the government has prioritised the City ahead of industry, maintaining a strong pound has come at the expense of British industry that can no longer be competitive in a global market and the result of this is most vividly seen in the north of the country.

Conclusion

Britain is broken. The UK is becoming an increasingly difficult and unpleasant place to live for many. The scope and magnitude of Britain’s economic problems are serious and need to be addressed as soon as possible; higher prices, higher taxes and poorer public services along with a lower standard of living is probably the best-case scenario as things currently stand.

Britain cannot borrow its way out of these problems, it cannot tax any more than it currently is and most of its assets have been sold off already. We are in the middle of a cost of living crisis and all our public services are in desperate need of more funding and investment so the government cannot reduce spending without increasing these problems. All of this is set to a backdrop of low growth, high debt and record-high inflation. Confidence in our politicians has arguably never been lower and how any government will even attempt to solve these problems is beyond me. As things currently stand, broken Britain is likely beyond repair.

Laville, S. and Leach, A. (2022) 'Water firms’ debts since privatisation hit £54bn as Ofwat refuses to impose limits,' The Guardian, 2 December. https://www.theguardian.com/environment/2022/dec/01/water-companies-debts-since-privatisation-ofwat-refuses-impose-limits#:~:text=11%20months%20old-,Water%20firms'%20debts%20since%20privatisation%20hit%20%C2%A354bn,Ofwat%20refuses%20to%20impose%20limits&text=Ofwat%20is%20refusing%20to%20limit,%C2%A354bn%20accrued%20since%20privatisation.

Boulton, A. (2022) 'Nationalised utilities once favoured unions, but capitalists do not seem to be serving the public either - Adam Boulton analysis,' Sky News, 19 August. https://news.sky.com/story/nationalised-utilities-once-favoured-unions-but-capitalists-do-not-seem-to-be-serving-the-public-either-12676365.

Energy (2023). https://weownit.org.uk/public-ownership/energy.

Boulton, A. (2022b) 'Nationalised utilities once favoured unions, but capitalists do not seem to be serving the public either - Adam Boulton analysis,' Sky News, 19 August. https://news.sky.com/story/nationalised-utilities-once-favoured-unions-but-capitalists-do-not-seem-to-be-serving-the-public-either-12676365.

Delestre, I. (2023) British tax system is in need of reform. https://ifs.org.uk/articles/british-tax-system-need-reform.

If we can’t have lower corporate taxes, can they at least be stable? (2023). https://ifs.org.uk/articles/if-we-cant-have-lower-corporate-taxes-can-they-least-be-stable#:~:text=Our%20corporation%20tax%20take%20as,the%20lowest%20in%20the%20G7

Hinsliff, G. (2023) 'Collapsing schools are the latest sign of a crumbling country – and a lesson in Tory cost-cutting,' The Guardian, 5 September. https://www.theguardian.com/commentisfree/2023/sep/05/collapsing-schools-crumbling-tory-quick-fixes.

Savage, M. (2023) '700,000 pupils being taught in schools in England that need major refurbishment,' The Guardian, 19 November. https://www.theguardian.com/education/2023/nov/19/pupils-being-taught-in-schools-in-england-that-need-major-refurbishment.

Allegretti, A. (2022) 'Parliament renovation could take 76 years and cost £22bn, report says,' The Guardian, 23 February. https://www.theguardian.com/politics/2022/feb/23/parliament-renovation-could-take-76-years-and-cost-22bn-report-says.

Cotterill, B. (2022) 'Britain's education system is 'failing on every measure' - with 'shocking' regional disparities uncovered,' Sky News, 15 June. https://news.sky.com/story/uks-education-system-is-failing-on-every-measure-with-shocking-regional-disparities-uncovered-12634175.

Skopeliti, C. (2023) '‘Year 10 was a write-off’: the pupils at the sharp end of England’s teacher recruitment crisis,' The Guardian, 14 July. https://www.theguardian.com/education/2023/jul/13/how-teacher-shortages-in-england-are-affecting-pupils#:~:text=%E2%80%9CSome%20of%20her%20friends%20were,a%20specialist%20teaching%20some%20lessons.

Ofsted (2023) 'Ofsted Annual Report: Steadily improving picture in education and care, but ‘social contract’ remains fractured,' GOV.UK, 23 November. https://www.gov.uk/government/news/ofsted-annual-report-steadily-improving-picture-in-education-and-care-but-social-contract-remains-fractured.

Triggle, B.N. (2023) 'Hospital waiting list tops 7.5 million in England,' BBC News, 10 August. https://www.bbc.co.uk/news/health-66460309.

Sky News (2023) 'NHS: Around 23,000 excess deaths in 2022 were 'linked to A&E waits', college claims,' Sky News, 28 February. https://news.sky.com/story/nhs-around-23-000-excess-deaths-in-2022-were-linked-to-a-e-waits-college-claims-12821720.

Williams, H. (2023) 'Record 2.5m off work with long-term sickness as unemployment rises again,' The Independent, 16 May. https://www.independent.co.uk/business/unemployment-statistics-sickness-ons-b2339882.html.

McRae, I., Westwater, H. and Glover, E. (2023) 'UK poverty: The facts, effects and solutions in the cost of living crisis,' The Big Issue, 24 October. https://www.bigissue.com/news/social-justice/uk-poverty-the-facts-figures-effects-solutions-cost-living-crisis/.

ibid

Butler, P. (2023) 'Poorest UK families enduring ‘frightening’ collapse in living standards, survey finds,' The Guardian, 18 August. https://www.theguardian.com/business/2023/aug/18/uk-poorest-families-fall-in-living-standards.

UK Poverty 2023: The essential guide to understanding poverty in the UK (2023). https://www.jrf.org.uk/report/uk-poverty-2023.

Martin, B.H.C.& D. (2023) 'What is happening at ‘bankrupt’ Nottingham City Council?,' BBC News, 1 December. https://www.bbc.co.uk/news/uk-england-nottinghamshire-67577142.

Murray, J. (2023) 'Birmingham city council ignored bankruptcy warning signs, says expert,' The Guardian, 13 November. https://www.theguardian.com/uk-news/2023/nov/12/birmingham-city-council-ignored-bankruptcy-warning-signs-says-expert.

Brexit and the economy: the hit has been ‘substantially negative’ (2022). https://www.ft.com/content/e39d0315-fd5b-47c8-8560-04bb786f2c13.

Chu, B. (2017) 'Brexit to cost Britain more than 5% of GDP by 2030, say City economists | The Independent,' The Independent, 23 January. https://www.independent.co.uk/news/business/news/brexit-to-cost-britain-more-than-5-of-gdp-by-2030-say-city-economists-a7541616.html.

Hickman, M. (2006) ‘The great brands sell-off: Once we were British’ The Independent at : https://www.independent.co.uk/news/uk/this-britain/the-great-brands-selloff-once-we-were-british-6103964.html

Martin, R. and Sunley, P. (2023) 'Capitalism divided? London, financialisation and the UK’s spatially unbalanced economy,' Contemporary Social Science, pp. 1–25. https://doi.org/10.1080/21582041.2023.2217655.

I wonder if the markets will decide the UK is basket case at some point resulting in a large devaluation of the pound, which will likely raise inflation and the cost of borrowing. John Gray thinks we could be heading to an Argentina situation.

https://youtu.be/yCG1-30auFc?si=Va7FJJJHjbC4UMIi

I think it was this video he talks about it.

It does appear even with the shortage of housing and rising population prices are coming down quite quickly.

The economic shock required to make the UK grow again is outside the Overton window for MSM to contemplate. Will it be forced on us?

You say that Britain suffers from a strong £ that favours the City over exporters, but also that the fall in the £ has led to higher import prices which go on to reduce exports. Which is it?

Of course the right answer is to define the £ in terms of a commodity like gold or silver, reducing both financialisation and inflation.